12-17-2025

Imagine that you are a university academic advisor and one of your students comes to you for advice. The student is trying to manage a dual major but is struggling with the coursework and, to date, has a poor grade point average. Your advice might be to have the student drop the dual major, keep the major that the student feels more passionate about, and focus on getting better grades going forward on this narrower curriculum.

The Federal Reserve is unusual in that Congress has given it a dual mandate where each half is treated as a co-equal. Most major central banks have a single (or a primary) mandate focusing on price stability. For example, the European Central Bank's mandate is “to maintain price stability in the euro area to preserve the purchasing power of the single currency.” The Bank of Japan's mandate is “to ensure sustainable price stability.”

The dual mandate complicates the Fed’s mission, requiring at times like the present, as Chair Powell remarked in his recent speech, a “balancing of risks” to each side of its mandate. Similarly, as indicated by the Fed’s inflation report card, the Fed has been struggling over the past four years to get good grades on inflation. The Fed’s “price stability” mandate is complicated enough without the Fed having to also worry about “maximum employment.”

Like the academic advisor telling the student to drop the dual major, Congress should drop the Fed’s dual mandate so the Fed can focus exclusively on “stable prices.” This does not mean that the Fed would no longer pay attention to labor market developments. Rather, monetary policy would not react directly to these developments but instead only to how they affected the Fed’s outlook for inflation. With inflation getting the Fed’s undivided attention, its inflation grades should improve.

This would also create a cleaner delineation between monetary and fiscal policy. The Fed (monetary policy) would have responsibility for inflation. The Administration (fiscal policy) would have responsibility for economic growth and employment. Accountability would be clear for both the Fed and the Administration. The Fed would be accountable for inflation and only inflation.

This separation of responsibilities would also bolster the Fed’s independence and its non-partisan approach to policy decisions. Pressure on the Fed is often motivated by an administration’s desire for faster economic growth or lower unemployment. With both of these objectives clearly assigned to fiscal policy, it would be more difficult for an administration to blame the Fed for subpar performance in these areas. With only an inflation mandate, it would make no sense for an administration to pressure the Fed to lower its policy rate because inflation is above target. Yet, with the dual mandate, this is exactly what has been happening this year.

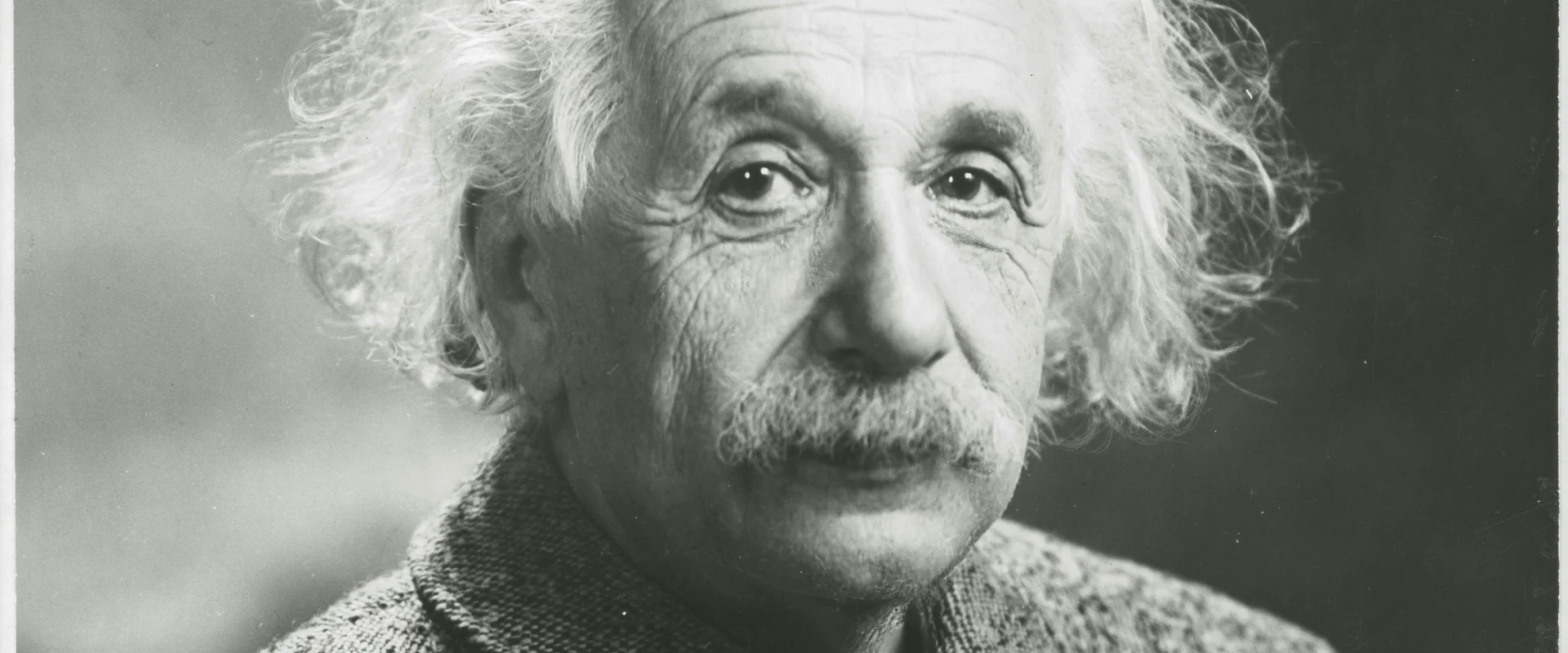

Monetary policy is difficult. Physics is also difficult. Albert Einstein offered the following advice, which applies to both endeavors: “Everything should be made as simple as possible, but not simpler.” Congress should take Einstein’s advice and simplify the Fed’s mandate.

Joseph Tracy is a Distinguished Fellow at Purdue University’s Daniels School of Business and a nonresident senior fellow at the American Enterprise Institute. Previously he was executive vice president and senior advisor to the president at the Federal Reserve Bank of Dallas. He regularly contributes insightful posts about financial markets to Daniels Insights.