06-16-2025

In part one of a three-part series, Professor J.T. Eagan talked about the need to design an innovative case study that would emphasize course content while enhancing students’ soft skills. Today’s installment describes how the course is implemented.

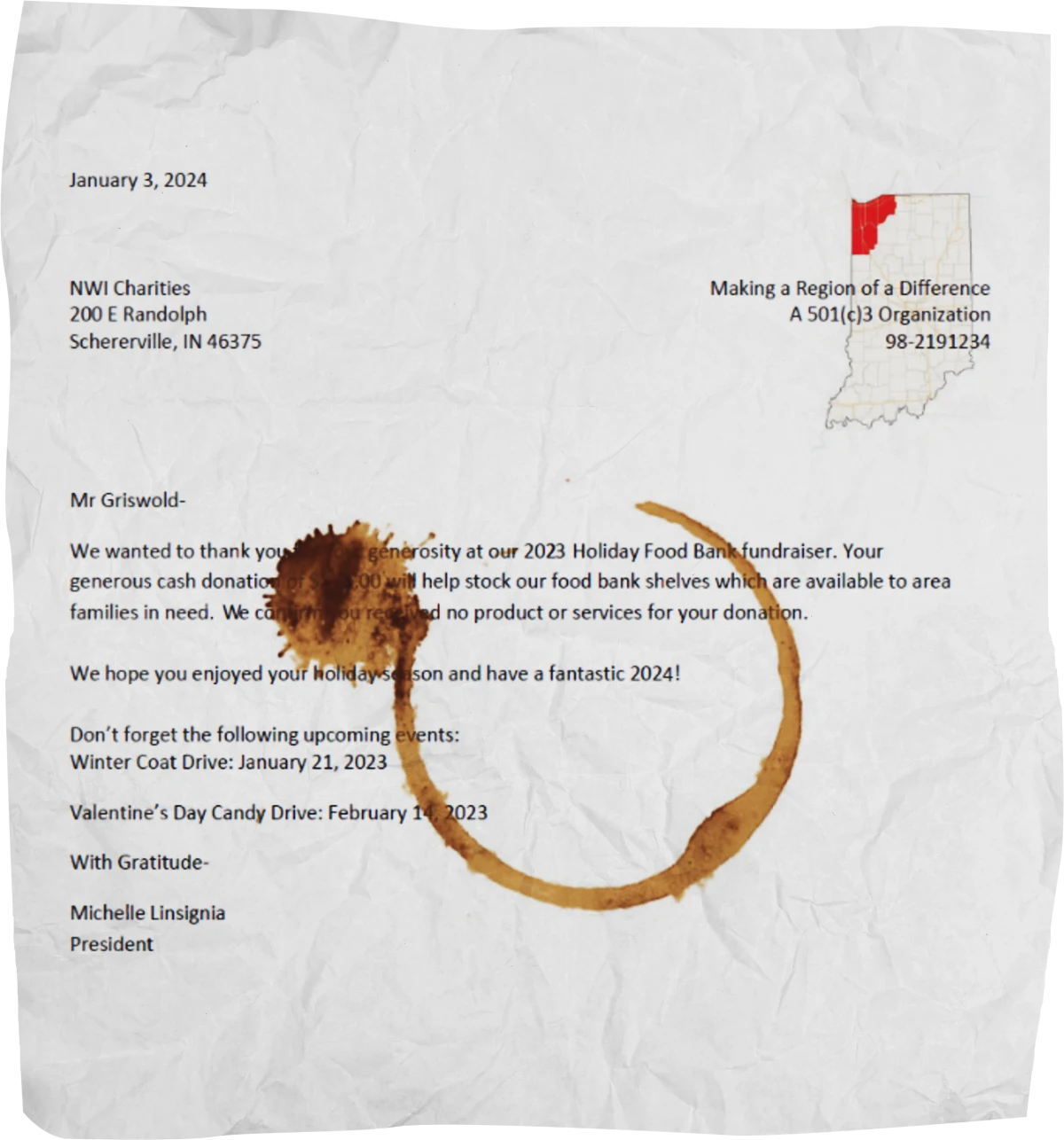

Students are handed a pile of “tax stuff” and introduced to our client, the Griswold family. The development of realistic tax documents starts the simulation for students. Client papers are messy; tax professionals often have to think critically about what components they have to formulate relevant follow-up questions. The tax papers include typical documents seen in practice: W-2, 1099-INT, 1098, 1098-E, 1099-B, and a charitable contribution letter. Ten tax technical aspects, often absent in practice, are also absent herein.

For example, the student would need to apply what they have learned in class to observe the acquisition date of Wally World Inc. stock is missing (Wally World Inc. being an Easter Egg to the original Vacation movie). Another example, shown here, would be a coffee-stained charitable contribution letter; my special thanks to Tom Brown for taking the time each semester to print out this collateral in full color to immerse our students. These follow-up questions are critical to apply the proper tax treatment.

Students submit their follow-up questions with the client directly to a separate email address to further the simulation. While the rubric grades on the tax technical aspects of the submission, the submission does provide a platform to give constructive criticism on the tone and formatting of their email to a client. Students are then provided with a comprehensive debrief video to understand what should/should not have been asked along with the client’s direct response.

There is an excellent byproduct within this project that enhances a student’s overall financial acumen as we get to discuss tax and life planning, such as saving for a home purchase, higher education and retirement.

Perhaps the most demanding aspect of this project is by far the most rewarding for me as an instructor. As part of the project, I require students to meet with me individually for 20 minutes to present their work.

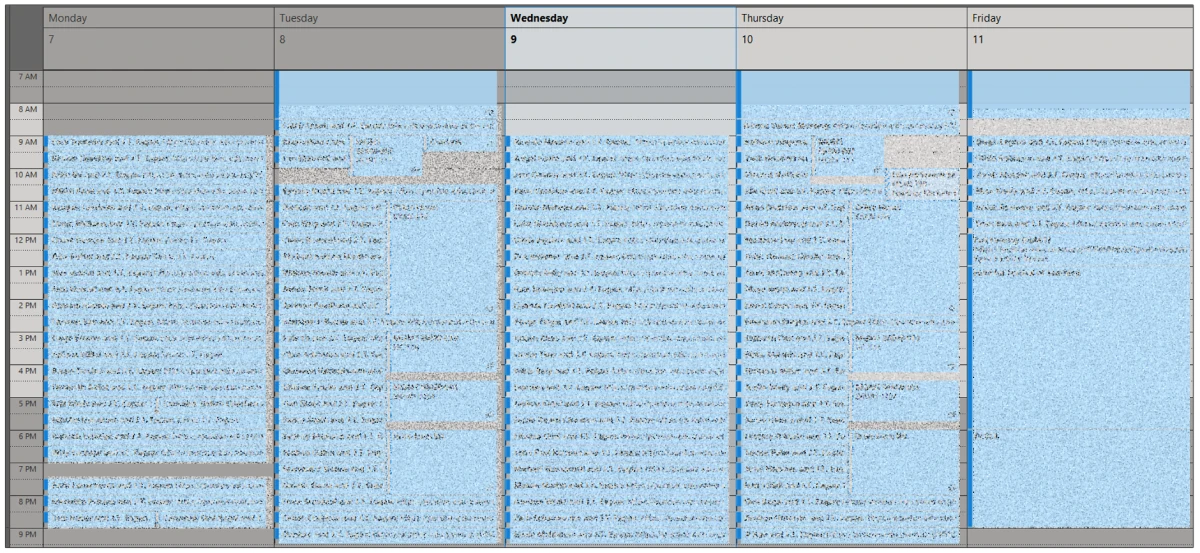

For the Spring 2025 semester, I had 106 students across two sections. For reference, this is a screenshot of my Outlook calendar for the week in which the meetings were held. It is a marathon week of 14-hour days, but the value to students is incredible.

The primary purpose of this meeting is to further the simulation. In practice, staff are often asked to present their work to the manager or partner for review. While these meetings follow a tax technical rubric for assessment, I have had the pleasure of having conversations on everything from employment to obtaining a master’s, just to name a couple. I often hear from students that they are graduating and yet this meeting was their first one-on-one with a professor. It is truly impactful not only on the high-performing students, but those needing a little extra push as well.

Most clients will have at least some questions about their tax return; Clark Griswold is no exception. A debrief video is provided to students in which we discuss what the correct answers were for Part I (though most students have a solid understanding from the one-on-one meeting).

Students are directed to call the client back at the provided number and leave a voicemail responding to the client’s concerns. The submission is encouraged to be 90 seconds or less and is graded based on the tax technical aspects.

The system has an MP3 download feature where each voicemail is then posted to Brightspace for students to listen back on their submission. The grading rubric is based on the tax technical, but the constructive feedback has tremendous value for students in developing their soft skills.

I often hear from students that they have never left a voicemail. My general retort: Even if they do not end up in tax as a career, at some point in the very near future they will need to call and leave a confident voicemail simply to say “thank you for the interview.”

J.T. Eagan is a clinical assistant professor in accounting at the Daniels School. He has almost 20 years of diverse tax experience and was voted the Outstanding Undergraduate Teacher for the 2023-24 and 2024-25 academic years by Daniels School students. Next week, in part three of the series, he'll talk about student reaction and academic impact of the project.