01-06-2025

As COVID-19 hit the economy the Fed had a problem — it had been consistently missing its inflation target of 2 percent for nearly 10 years. When the economy convalesced from the health crisis the Fed still had a problem — it was again consistently missing its inflation target. As Yogi Berra said, “Its Déjà vu all over again.” The difference is that the Fed was undershooting its inflation target before COVID-19 and overshooting its target after COVID-19. What happened in between?

In August 2020, the Fed changed its operating framework to a Flexible Average Inflation Targeting (FAIT) approach where it would aim to have PCE inflation average 2 percent over “some time.” The concern by the Fed when considering this revision to its policy framework was that its persistent undershoot of inflation would lead market participants to lower their inflation expectations making it even more difficult for the Fed to hit its 2 percent target. The goal of FAIT was to help anchor inflation expectations at 2 percent.

Inflation changed dramatically following the adoption of the new framework. This is illustrated in Figure 1 which shows the Dallas Fed Trimmed Mean PCE inflation rate. From January 2012 when the Fed defined “price stability” as PCE inflation of 2 percent to August 2020 when the Fed adopted FAIT, the Dallas Trimmed Mean PCE inflation averaged 1.75 percent. From the announcement of the new framework in August of 2020 to the present, the Dallas Fed Trimmed Mean inflation averaged 3.36 percent — nearly double its prior average.

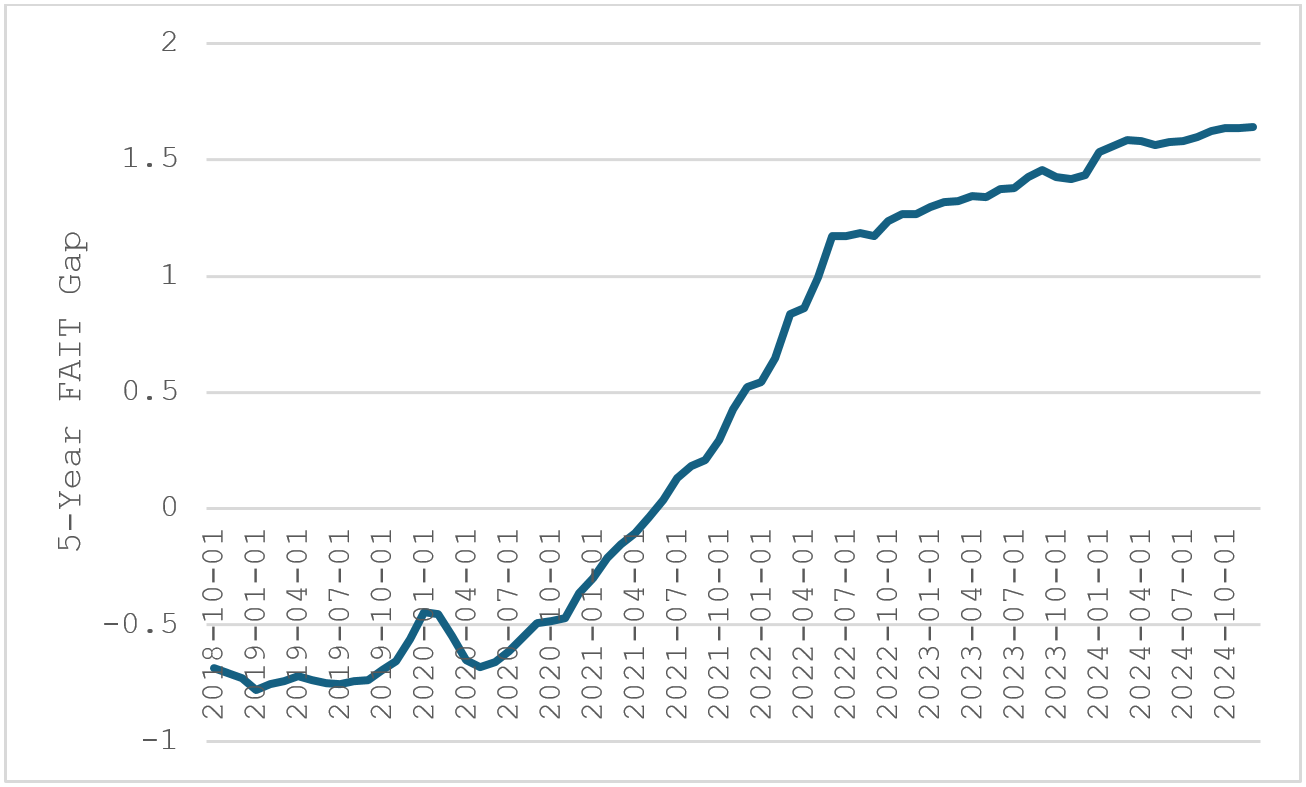

In announcing its new framework the Fed did not define “some time," leaving others to assume that under the new framework, the Fed would attempt to average 2 percent inflation over a 5-year window. We can look at how it has been doing based on this FAIT metric since the new framework was announced. This FAIT track record is shown in Figure 2.

The Fed went from having a 5-year inflation average that was more than 50 basis points below target when it announced its new framework to more than 150 basis points above target. The pace of the increase in the 5-year FAIT gap slowed following the Fed’s tightening of monetary policy in the Spring of 2022. With the size of the current FAIT gap, even if PCE inflation follows the median forecast in the Fed’s December Summary of Economic Projections (SEP) and then stays at 2 percent, the gap will not be closed in 5 years.

The Fed modified its policy framework in August 2020 to emphasize a goal of averaging 2 percent PCE inflation over a period of time. Since its adoption, this Flexible Average Inflation Targeting approach has not gone well for the Fed. The last several years have been like a ride on a Coney Island inflation roller coaster. The fate of FAIT is an important question for the Fed’s 2025 framework review.

Joseph Tracy is a Distinguished Fellow at Purdue University’s Daniels School of Business and a nonresident senior fellow at the American Enterprise Institute. Previously he was executive vice president and senior advisor to the president at the Federal Reserve Bank of Dallas.