02-27-2025

The Federal Reserve in August 2020 announced two changes to their operating framework. The first is that they adopted a Flexible Average Inflation Targeting (FAIT) approach. The second is that they indicated that they would now only respond to “shortfalls” and not “deviations” in the unemployment gap. How consequential is this second change to the Fed’s operating framework discussed in my prior post? A first step in considering this question is to look at the behavior of the unemployment gap over time. The figure below shows an estimate of the unemployment gap from 1970 to present.

One feature is that shortfalls (negative unemployment gaps) tend to be larger in absolute magnitude than positive unemployment gaps. Over the more than 50 years the median negative unemployment gap is –1.22, the median positive unemployment gap is only 0.56 during the same time period. Periods of slack labor markets also tend to be longer in duration. For the 14 completed gap spells in the data shown above, the median slack labor market duration is 15 quarters, while the median tight labor market duration is 11 quarters.

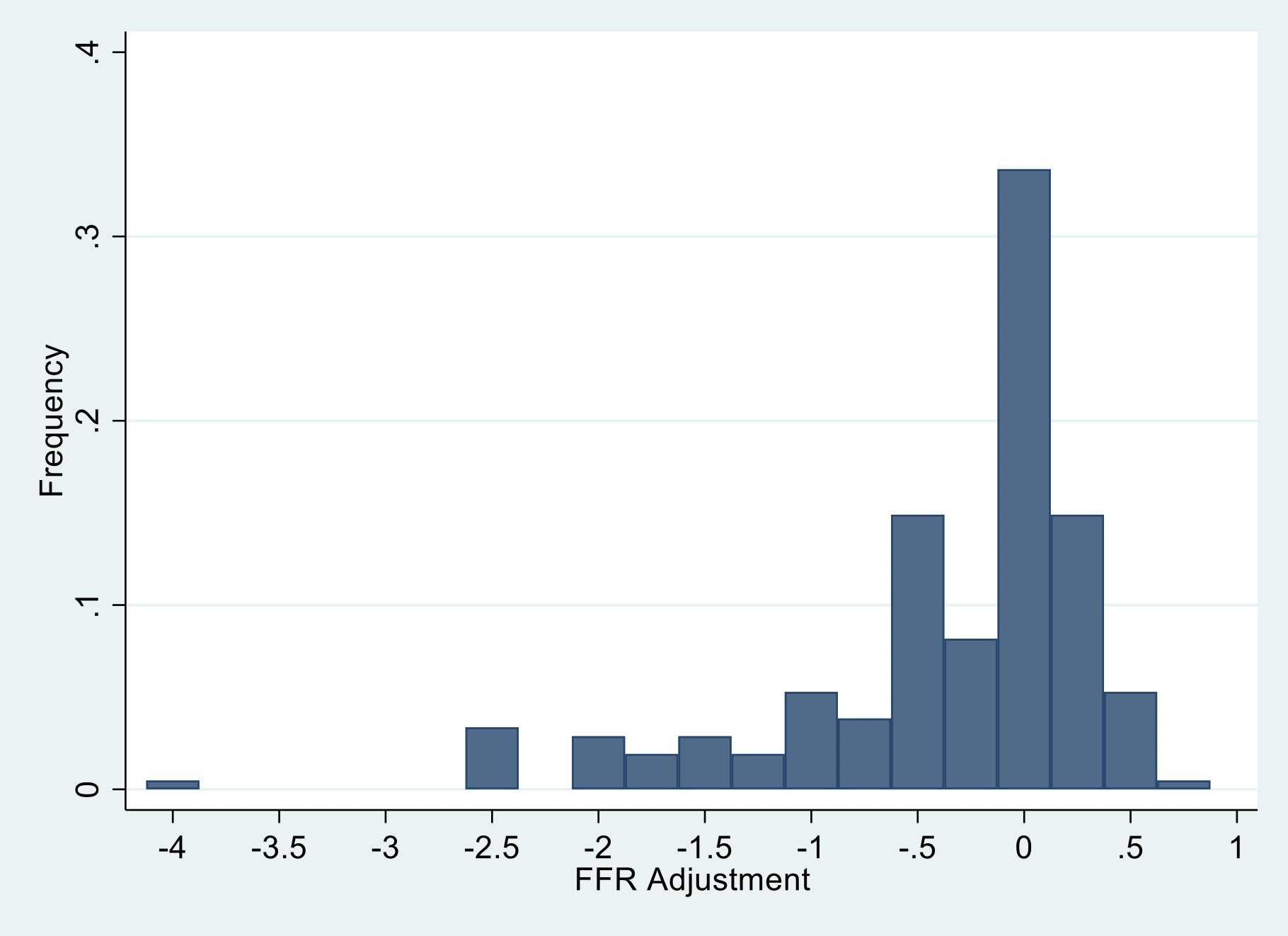

These features of unemployment gaps imply that shortfalls are the more important unemployment gap in terms of adjusting monetary policy. To illustrate this, we can estimate policy rate adjustments using the data above on unemployment gaps and a Taylor Rule with a coefficient of 0.5 on the unemployment gap. The figure below shows the distribution of implied adjustments to the Fed’s policy rate due to the unemployment gap. In assigning a policy adjustment to an unemployment gap we round to the nearest 25 basis point change.

The most frequent outcome, occurring in roughly a third of the quarters, is that the unemployment gap does not contribute to setting the policy rate — that is an implied adjustment of 0. When the unemployment gap does contribute to the calibration of monetary policy, the magnitudes of the adjustments are much larger for negative gaps even when we exclude the COVID-19 outlier of –400 basis points. In contrast, tight labor markets typically result in adjustments to the policy rate of only 25 or 50 basis points.

Based on history, the Fed’s decision to adjust monetary policy to shortfalls rather than to deviations in the unemployment gap will not impact its policy stance for the vast majority of Federal Open Market Committee (FOMC) meetings. This suggests that this change to its operating framework is not likely to be very consequential for the calibration of monetary policy. For the current rate cycle, if the Fed followed its prior approach to reacting to deviations in the unemployment gap, the Taylor Rule would have indicated an unemployment-gap-based 25-basis point increase in the first quarter of 2022. Consequently, this would not have, on its own, moved up the beginning of the Fed’s tightening cycle.

In the end, the choice of shortfalls or deviations may be more a matter of taste over substance. Like in nature, my preference is for symmetry.

Joseph Tracy is a Distinguished Fellow at Purdue University’s Daniels School of Business and a nonresident senior fellow at the American Enterprise Institute. Previously he was executive vice president and senior advisor to the president at the Federal Reserve Bank of Dallas.