09-20-2024

The Federal Open Market Committee (FOMC) decided at its recent meeting to begin the process of normalizing monetary policy taking an initial 50 basis point reduction in its policy rate. As I indicated in my last post, the destination for monetary policy — where the FOMC should aim to set its policy rate when both the inflation and unemployment gaps are closed — is an important consideration now that the Fed’s journey home has begun.

The FOMC should be steering its nominal policy rate to the natural rate of interest plus 2 percent. However, the natural rate of interest, like the natural rate of unemployment and underlying inflation, cannot be observed and must be estimated.

There are a number of different macro-economic models that produce estimates of the natural rate of interest. Three models are updated on the Federal Reserve Bank of NY’s website. The Laubach-Williams model estimates r* at 1.22 percent and the Holston-Laubach-Williams model at 0.74 percent (2024 Q2). The FRBNY DSGE model estimates a 90 percent range for r* from –0.33 to 1.44 which gives a mid-point value of 0.55. A fourth model is updated at the Richmond Fed website. The Lubik-Matthes model estimates r* at 2.6 percent. So, these four different models provide estimates of r* ranging from 0.55 to 2.6.

This is an uncomfortably large range. If we follow typical sports judging procedures and throw out the high and the low estimates and average the remaining two estimates, we have a value of 0.98 percent. Taking this as our “best guess” of r*, the neutral Fed policy rate would be roughly 3 percent. This would indicate that after the recent policy cut the Fed has 1.75 percent or 175 basis points of further rate cuts to arrive at home.

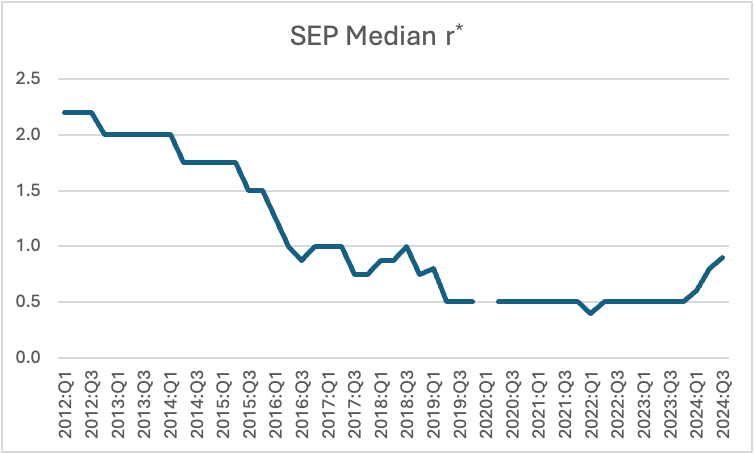

Given the wide range of model estimates for r* it is also instructive to look at the views of r* given by Fed members and participants. Since 2012, the Fed publishes four times a year the Survey of Economic Projections (SEP). One of the questions is what respondents think the long-run policy rate should be. Assuming that in the long-run the inflation and unemployment gaps are closed, we can interpret these answers as representing views on r* (after we subtract 2 percent). The chart below shows the “median” implied r* from these SEPs. The median r* was over 2 percent in 2012 and steadily declined to 0.5 percent by the end of 2019. Recently, their median estimate of r* has risen to a value of 0.9 percent in the September meeting. However, the range across the middle half of the committee goes from 0.75 percent to 1.37 percent. The median estimate is very close to the trimmed average of the model estimates.

So, the Fed has started on its journey to normalize its policy rate, but the destination of monetary policy is uncertain. There are no ruby slippers that the Chair can click together to take the Committee home. We can be reasonably sure that the Fed still has some distance to travel. However, as the Fed continues on this journey it will have to trust that it will “know it is home when it gets there.” This will require good instincts and judgment on the part of the committee.

Joseph Tracy is a Distinguished Fellow at Purdue University’s Daniels School of Business and a nonresident senior fellow at the American Enterprise Institute. Previously he was executive vice president and senior advisor to the president at the Federal Reserve Bank of Dallas.